Manroe Realty Leading Through Nigeria’s Economic Transition

Did you know? You stand a better chance in the market with your properties on Manroe. Ride with the Manroe-wave and reach more potential buyers.

As Nigeria continues to implement bold economic reforms to navigate pressing fiscal challenges, a private initiative is leading in the real estate sector with an understanding of the economic shifts impacting Nigeria today.

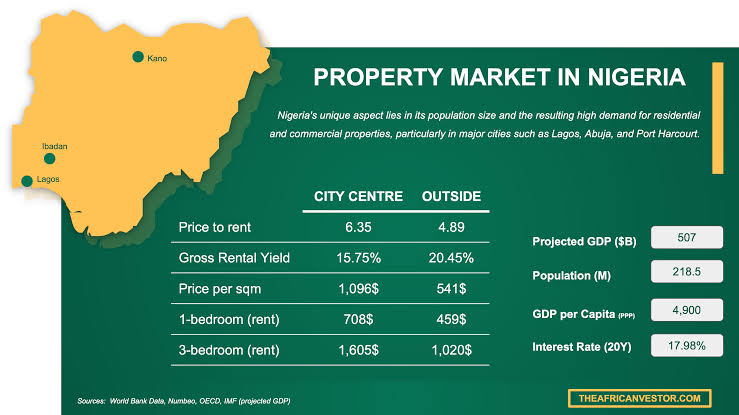

The World Bank’s recent Nigeria Development Update Report (October 2024), titled ‘Staying the Course: Progress Amid Pressing Challenges’, highlights the necessity of the reforms and underscores their initial impact on Nigeria’s macroeconomic health. These changes come at a time when Nigeria’s housing demand remains significant, and real estate developers like Manroe Realty Limited must adapt to align with the nation’s trajectory toward economic stability and growth.

Since May 2023, Nigeria has been on substantial reforms designed to stabilize the economy, reduce fiscal deficits, and increase foreign exchange reserves. While challenging, these policies are crucial for long-term development, and Dr. John Edumoh, Chief Executive Officer (CEO) of Manroe Realty, is optimistic about their potential impact on the housing sector.

With Nigeria’s foreign exchange reserves rising from $32.9 billion at the end of 2023 to $38.8 billion by October 2024, Dr. Edumoh views these economic buffers as reassuring signals that support increased investment in the country’s real estate sector. “Manroe Realty sees these reserves as stabilizing forces,” he explains. “They will help foster investor confidence, which is essential for sustained growth in real estate.”

However, inflation remains high, impacting purchasing power and posing challenges for households and businesses. Despite these obstacles, Dr. Edumoh is positioning Manroe Realty to offer accessible housing solutions with initiatives designed to increase affordability.

The report stresses that maintaining a tight monetary policy and a unified foreign exchange rate is essential to reducing inflation and creating a more predictable economic environment. For Manroe Realty, this environment is vital for making housing more accessible. As the Central Bank of Nigeria’s new foreign exchange policies stabilize, Dr. Edumoh is optimistic about the real estate sector’s ability to plan projects with greater accuracy and control costs more effectively. “The path to affordable housing becomes clearer when we have stable monetary policies and can navigate currency risks,” he says. “With clearer market signals, we can make calculated investments that benefit Nigerian families.”

By adhering to his company’s strategies and policies, Dr. Edumoh is ensuring that Manroe Realty remains a key player in helping Nigeria meet its housing needs. He recognizes that his focus is to ensure that housing projects are more financially sustainable, avoiding excessive debts and redirecting resources to targeted programs for the Nigerian population.